Join me on a deep dive into market structure! This tutorial is designed to cater to both beginners and advanced traders, so whether you’re just starting or looking to refine your skills, you’re in the right place.

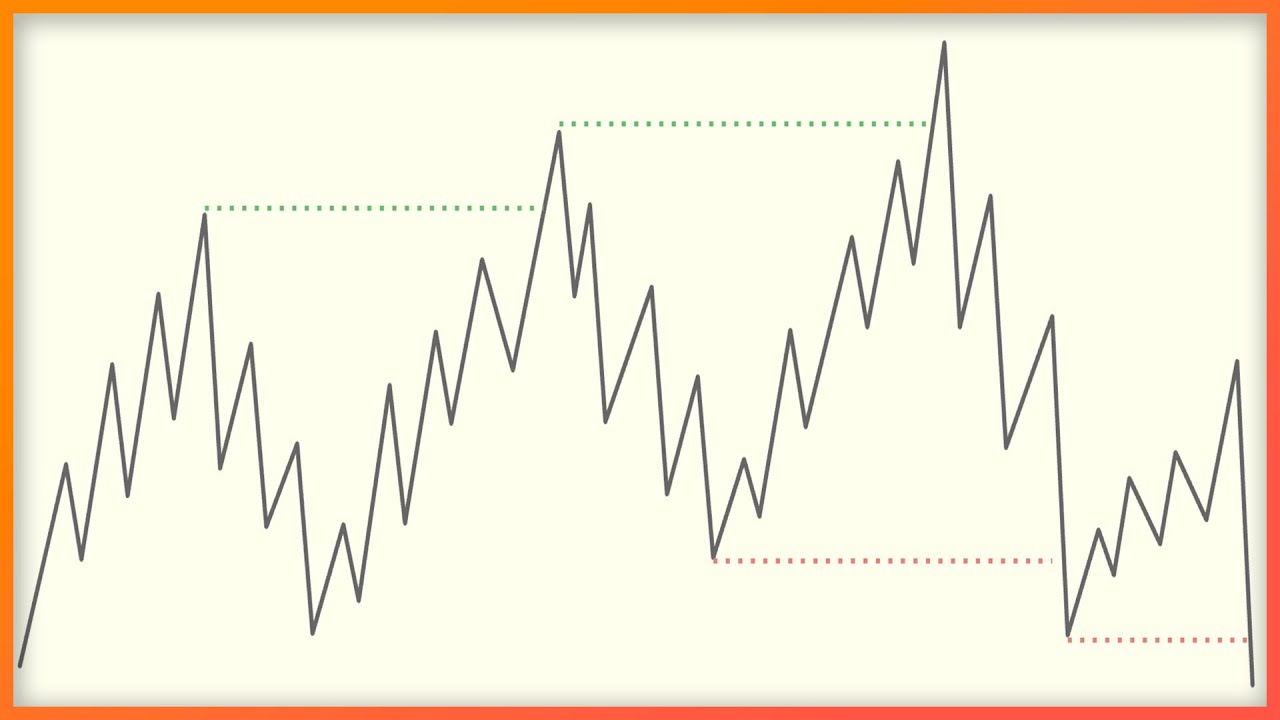

Get the basics: Understand what market structure is and why it matters.

Learn essential terms: Demystify jargon like support, resistance, and trends.

Actionable tips: Gain insights to identify basic market structures and make smarter trading decisions.

Advanced analysis techniques: Explore trading strategies and tools

Risk management: Learn how to protect your investments within different market structures and how to identify the right market structure shift and protect high and low.

Real-world examples: See these concepts in action through trading scenarios and case studies.

Whether you’re new to trading or seeking to enhance your skills, this tutorial will equip you with the knowledge to thrive in the world of market structure. Hit play and level up your trading game!

Don’t forget to subscribe for more valuable trading insights. 📺🔔

#trading #MarketStructure #tradingstrategy

Link do Vídeo

Thank you for watching 🙏

Check out @DaveTeaches here on YouTube

It works. You are the man. Thank you Stoic.

Your good at this.. Nice vid.

Thanks sir 🎉

Thanks a lot, Stoic ! Stay blessed

They underestimate the Importance of Market Structure. THIS is nr1 in Trading, that you have to learn. Nothing else matters. Great Video!!

1 hour video? this is way better than a few short ones, Thank you for your time and effort ♥

we wait another video boss

thanks for sharingg great video

Iam lucky see your video

Thank you sooooo much for sharing your knowledge and helping us traders climb this mountain of fire. Very well spoken and examples. I have the concept down for the most part just need to work a little more on finding the true reversals, and making sure im always in line with the macro trend. Sometime i get mixed up on pullbacks thats create a reversal pattern and think the whole trend changed. And also trading in a range is a bit hard at times. Ill continue to backtest until i past the this test with at least 75% accuracy 💪😁 at about a 65% percent now which is amazing. I know i wont be 100% all the time but thats where risk management have my back.

Thank you, very useful for me, who is studying in the NFC community

Hahaha Good one dude. "Do you know what you're doing"? Stoic 😂 💪

Good lookin man… if dave doesnt step up his production quality you will be credited with this amazing gem… keep up the good work…

cuz i know daves methods work….him mentioning you is why I am here, but the struggle in trying to understand his charts and drawings was a bit much for me. He even tells you to watch his videos 10 times each which shouldn't be necessary but if it is then so be it.. but thank god someone like you saw the need to simplify his teachings…thank god

"These are the areas you need to backtest" Stoic Trader. Along with forward test 1000s of entries. Then you will KNOW. "30/50/70 are training wheels" Dave Teaches

Hello i am trading now since 2020 and your first video change completely my trading with consistence outcome thank you

🙏

One question : I’m very familiar with the term unmitigated area could give me a quite explication please.

Pure alpha, right here. So well articulated. Such an easy concept and yet so overlooked. Thank you for taking the time to make this.

Many thanks Dave … incredible clear explanations …. Thanks!

Marvelous.

Sir pls making these videos

And Also Risk management and phycology

Another great video dude! If anyone is complaining about the length of the video, please ignore them. I TRULY appreciate your no BS style, always clear and straight to the point. Anything of importance is worth the time!

More vids like this one is highly appreciated. Thx for the value mate.

one step, one incident or one clip of video wont cahnge the fates..but all it takes to reach your desired destination–one step in right direction..this video is that one step 🙂

Please never stop

Awesome video and explanation, could you explain what rules must be met to consider an area mitigated once it returns, What percentage of area must price fill once it returns ? 30%? 50% ? 70% ? Thank you.

I like your accent

Thanks. 10x better explained than Dave and 20x less blabla. Excellent job. Could you elabirate why you use 1min + seconds chart. Why not a 15min + 1min for instance. Just want to know your rational for chosing that TFs. Thanks

If this works for you, cool, but I'ma stick with ICT. With his concepts I see much better entries than what you're explaining from this Dave dude. Your last video had some good gems that I scooped, tho.

Great video as always, keep it up bro! Keep the videos coming.

Brilliant! Thanks for sharing and your time

Hi would love you to see you put this in practice. Live trading n that's respect

"I love to scalp", yes.. especially the 40 or 100 handle scalps 😉 what a development, really inspirational!

Suggestion regular Top Down Analysis (5-10min) with "hind sight" possible trade analysis would get a lot of views in my opinion, thank you excellent work

Possibly the best 2 trading videos on all of Youtube – Very well described – Thank you

Pls show the fib settings I'm using OTE

SH BMS RTO 👌

At 40:56, isn’t the SECOND swing low after second orange zone from the left, “THE LOW RESPONSIBLE FOR a new HIGH”? According to your previous video, price closing below that would signal a trend reversal(= need to short). But, on the other hand, for the same graph, you are waiting to long because you consider “the origin of movement (the green region in the graph)” to be the true protected low. My question is this: how to distinguish the difference between these two swing low?

I have gone through Dave master class multiple times, understood the Fib tool usage differently compared to ICT. Then rest of the things just went above my head.

The organized way of explaining things is helping me a lot, please continue your teachings. thanks a lot for your time.

Please make it live trading with this trategy on demo account a post on youtube

Thank you , Great video .

Absolute insane video. Very well put together and explained. Keep these videos coming

Sensei 🥰