If you enjoyed this, please consider supporting the channel ⬇⬇⬇

🔢

🔢

——————

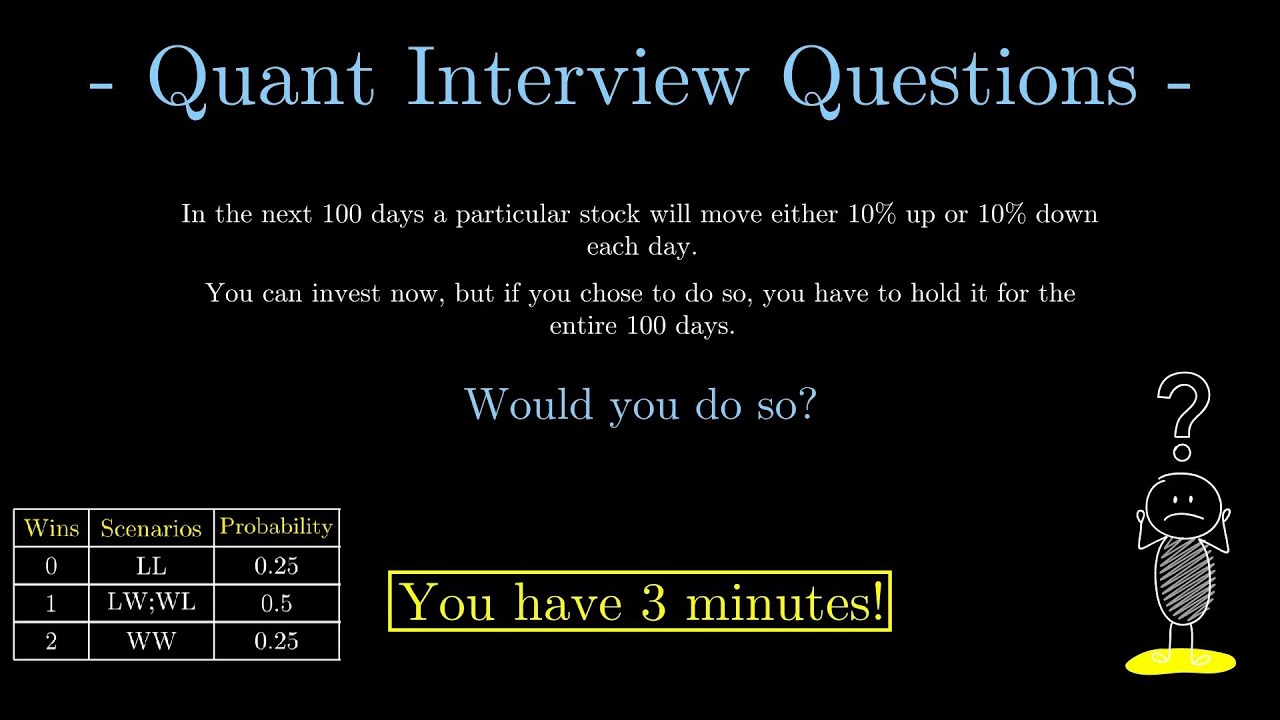

Question: For a given stock, you are certain that for the next 100 days, it will move either 10% up or 10% down each day (with 50% probability each). You can invest now, but if you chose to do so, you have to hold it for the entire 100 days. Would you do so?

Problem page:

——————

Timecodes

00:00 – Series Intro : Quant Interview Questions

00:16 – Question

00:50 – Understanding the Problem

02:30 – Solving the Problem

03:35 – Conclusion

04:00 – Outro

——————

Book recommendations:

Quant Job Interview Questions and Answers (Second Edition) –

Heard on The Street: Quantitative Questions from Wall Street Job Interviews –

——————

These animations are largely made using manim: Special thanks to 3Blue1Brown and the manim community!

Music:

——————

Various social media stuffs:

Reddit:

#quant #interviewquestions #manim #expectedvalue #stockmarket #binomial #probabilities #3blue1brown #janestreet

Link do Vídeo

Quant: need to find the expected value at day 100 to see if it's worth trading or not.

Technical Analyst: no need to find the expected value, no one knows exactly what it will be 100 days from now. Just plot the dynamic support and resistance, buy along the support of the trend and sell along the resistance.

This channel has been super helpful, keep up the good work!

Hi I'm a 10th grade student and I want to be a quant dev. I didn't learned this formula yet but I enjoyed the video

The Expected value for any given day is 0.5(1.1) + 0.5(0.9) = 1, then the ending value for 100 days is the product of 100 independent such random variables, since they are independent we can multiply their expected values and get 1^100 = 1. No need to use binomial formula

"Gov bonds are at every level a better option than this game". Negative yields – hold my beer. 🤓

Bro, easy stochastics problem. Brownian Motion: E[W(t)] = 0

3 minutes to do this ?

Ok, I escape from the room immediately and find a decent job!

Really very nice, impressive, post more of these

Hi, first I would like to say that this was a very good video as it was short and concise. That being said I would like to pose a question: If you know that each day the price of the asset is going to move in either direction by 10%, instead of investing in the stock itself why wouldn’t you place a non-directional volatility trade?

By the way, this is a completely genuine comment/question. I’m a teen who is just trying to learn more. Thanks!

Keep doing nice quant videos 🙂 I am your new subscriber

Why did you assume the stock will go up or down with probability 50% each day? I didn’t see that stated in the question anywhere.

This is just brownian motion. By the markov property we know the expected value is 100. However, if you want to get really fancy, you can solve a linear difference equation.

Easy to understand answer

At 3:23, how did you simplify the sum of X(k)'s using the binomial distribution. It resembles it, but the parameters are (1 + 1/10) and (1 – 1/10) and (1 + 1/10) is greater than 1 so differs from the parameters in a usual binomial distribution. How did you obtain the expected value of the sum from there?

Where can I find more of such questions (not the standard books), do you have a blog?